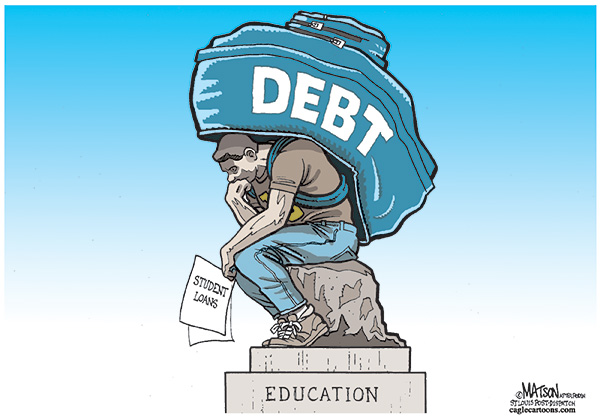

In at least 22 states, your student loan debt could wind up costing you more than your monthly bill – it could cost you your job.

Across the country, a growing number of jobs don’t just require a college degree, but also a professional license or certificate. These jobs come in all shapes and sizes, ranging from K–12 teachers and nurses to electricians and barbers. It’s now projected that nearly 30 percent of jobs legally require you to have a state-issued professional license in order to perform them.

In Alaska, California, Florida, Georgia, Hawaii, Illinois, Iowa, Kentucky, Louisiana, Massachusetts, Minnesota, Mississippi, Montana, New Jersey, North Dakota, Oklahoma, Tennessee, Texas, Virginia and Washington, nurses and health-care professionals can all be locked out from their job if they fall into default on their student loans.

In Georgia, Hawaii, Iowa, Louisiana, Massachusetts, Montana, New Jersey, North Dakota, Oklahoma and Tennessee, laws prevent K–12 teachers from working until they begin to repay their student loans.

Student debt, continues to be a growing problem in the United States. In our last blog, EDN announced that it will be collaborating with Jobs with Justice and United States Student Association on a campaign called Debt-Free Future. We sat down with Chris Hicks who is Debt-Free Future campaign organizer for Jobs With Justice to learn a little bit more about the campaign.

Here’s what we learned:

Can you tell us a bit about Debt-Free Future?

Recognizing that inequality cannot be addressed without addressing the role debt has on working people; Jobs With Justice launched the Debt-Free Future campaign in the fall of 2012. The campaign challenges the growing student debt crisis and its economic impact on recent college graduates, working individuals and families across the country. Student debt is increasing at a record pace at a time when wages have remained stagnant and unemployment remains stubbornly high. It is also the most difficult type of debt for individuals to escape under current laws and regulations. Debt-Free Future aims to address the debt-based economy by eliminating the burden of student debt and the repercussions it can have on student debtors, ranging from working to enroll debtors into existing debt-relief and flexible repayment options to challenging state laws that make it harder to pay back this debt. The partners of the Debt-Free Future campaign include the American Federation of Teachers, the US Student Association, the Student Labor Action Project, and the Highlander Research and Education Center.

How did this campaign come about?

In October 2011, members of the Student Labor Action Project that were active in Occupy Wall Street organized protests at the Sallie Mae headquarters in Washington, D.C., which quickly struck a public nerve as student debt grew to more than $1 trillion dollars only a few months later. By March 2012, the Student Labor Action Project and the U.S. Student Association organized another demonstration outside of the Sallie Mae headquarters in Washington with more than 300 students that ended with more than 36 students being arrested while demanding a meeting with Albert Lord, the CEO of Sallie Mae.

Why is this campaign important?

When we look at student debt impacts our entire economy, it’s clear that this issue has ripple effects impacting every aspect of our society. We often hear about young people not being able to buy homes because of their student debt, but it goes far beyond that. Between 2005 and 2013, student loan debt among seniors 65 and older rose by more than 600% from $2.8 billion to $18 billion, with 156,000 seniors having their social security garnished in 2013. For workers that fall into default student debt can cost them much more than their monthly payment, it could cost them their jobs. At least 21 states have existing laws that can suspend their professional or driver’s licenses, largely targeting public school teachers and nurses. Student debt is an issue that forces workers to delay starting families, making major purchases, saving for retirement, and actually being able to work. These problems are already becoming more common, and if we don’t do anything about them, our entire society and economy will suffer for it.

What kind of progress have you made in this campaign?

Since the campaign launched in 2011, we’ve worked with student debtors around the country to challenge the debt-based economy that’s developed around student debt. From passing shareholder resolutions at Sallie Mae’s annual shareholder meeting to repealing working with local partners in states like Montana to repeal laws that suspended professional driver’s licenses, we’ve always tried to find ways to engage those most directly impacted by this issue. We’ve successfully put a spotlight on the bad actors that perpetuate and financially benefit from the student debt crisis and replace them government agencies tasked with helping student debtors get out of debt.

Why is important for the members of EDN to care about this campaign?

Although there are millions of individuals struggling under the common burden of student debt in their pursuit of higher education, if we are to build a broad-based movement, we must understand how this common burden is experienced differently by people with different backgrounds.

Today, 83% of black Americans graduating from college have student loans compared to only 64% of white Americans. More women take on student debt to finance their education then men, and because of the wage gap that still exists today, 53% of women are having to put more money to their monthly student debt bills than an individual can reasonably afford compared to just 39% of men. Too often, this aspect of student debt is skimmed over – or worse, not even mentioned. Higher education has changed a great deal in recent decades, and if we want to continue to evolve it to work for everyone, we cannot afford for these different experiences to be invisible.

If higher education costs continue to grow, and students continue to have to go into debt in order to attend, the communities that will struggle to keep up the most are the ones that already have the greatest barriers in front of them. Organizing our communities to understand these obstacles and how to solve them, we are able to keep the idea of attending higher education real.

How can one learn more about the campaign?

In our work campaigning for better solutions to the student debt crisis, we’ve run into very few people who are informed about their repayment options, or knew about a government program called “Public Service Loan Forgiveness.” The program allows individuals working full-time in public service to have all of their direct federal student loans forgiven, tax-free.

If you aren’t familiar with the program – you’re not alone. An estimated 33 million people are eligible, but only 222,387 borrowers are estimated to be enrolled! You can learn more about this critical program in our free webinar. You can RSVP to the webinar for free here!

Webinar: Am I Eligible? Public Service Loan Forgiveness 101

Tuesday, April 28, 2015 7:00 pm Eastern / 4:00 pm Pacific

Even if you don’t work for a nonprofit or for the government, there are still ways that you can reduce your monthly payment through free federal programs! You can learn more about income-driven repayment plans that can lower your monthly bill to as low as $0 a month and how to apply with your student loan servicer at the website and on the webinar.

How can someone be engaged?

For those that want to engage in the campaign, I would say the first thing to do is talking to friends, family, and other EDN members about student debt. Much like other types of debt, there are stigmas around this issue and many are afraid to bring it up. But by starting the conversation, we allow people to share their stories and concerns, and then begin working towards finding real solutions for them. The Debt-Free Future campaign will continue to hold monthly webinars that you can join, and we would love to hear from you all would issues you’d like us to cover. You can also like our campaign on Facebook here to get the latest information.